ESP

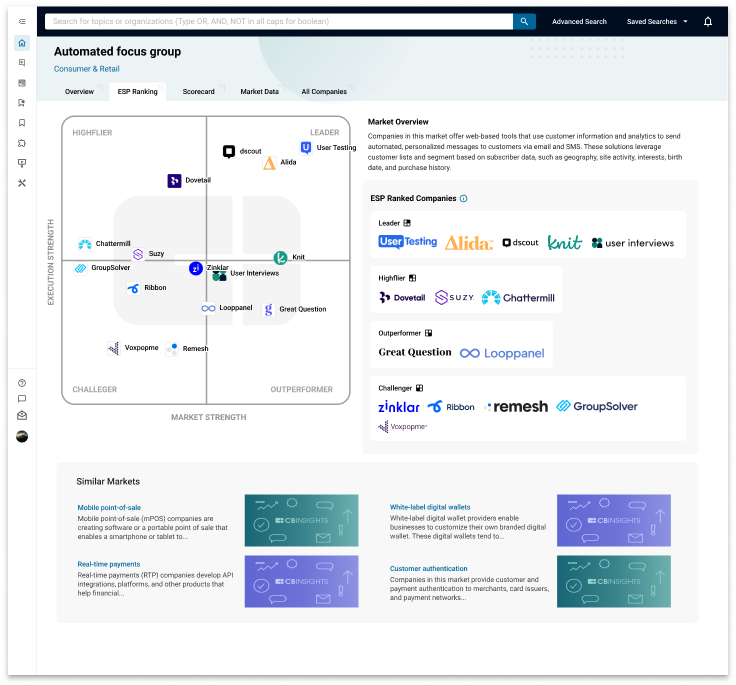

Execution & Market Strength Positioning (ESP) Matrix is a research product designed to help our customers quickly understand a given market landscape. The ESP Matrix provides a shortlist of companies in a given market category and ranks them based on their ability to execute and their market strength.

Problem

New customers don't have an aha moment in the platform that creates a weekly habit in the first 30 days.

Onboarding team has walkthrough sessions for new users, but they don't always happen since many prefer a DIY approach on their own time. As a result, Week 4+ retention drops and makes renewal conversations more difficult.

Business Value

67% of our new users are inactive, dormant, or churned by Week 4. This is our biggest opportunity to move the needle for retention - by impacting the aha moments every new user has. By creating a habit loop early on, we can push each team towards getting 3+ users active every week on the platform.

Team

Trio

Nectar (Senior Product Designer)

Product Manager

Engineer Manager

Collaboration

Research, Products and Operations (RPO) Team

Intelligence Unit (IU) Team

Marketing Team

Engineer Team

Timeline

3 months

Process

The customer health score is a 0 to 10 value that determines chances of renewal. This score was built by RevOps and CS teams over the past six months. There are four components of platform usage that contribute to a healthy CHS score:

View a Profile

View Research

View a Collection

View a Market Report

If we know customers are renewing because of these four actions, we can use that to form the foundational habit when they sign up during onboarding. We should also prevent them from hitting other features such as Notes, Stories, Connect Tracker, etc where they will have empty states for first-time users. (See full list further in the doc)

Given our customers have different goals and objectives, we'll split them into three personas for onboarding/activation:

Competitive Analysis

Upon receiving this project, my initial action was to acquaint myself with the existing quadrants. I extensively researched Gartner's Magic Quadrants, Forrester's Wave, and G2's Grid. Conducting an analysis, I identified successful elements, shortcomings, and potential areas for improvement for CB Insights in our new product. A significant lesson gleaned from our examination of Gartner's Magic Quadrant and Forrester's Wave was the challenge both companies faced in rapidly scaling these products.

A question that I asked for someone who hasn’t created a research product such as this is: Is a quadrant the best way we can see momentum of a list of companies in an industry?

Lo-Fidelity Designs

Main goals for MVP were:

Ability to place companies based on 4 pilars:

See key insights about for each company and to be able to take users to company’s full profile

Download feature

Screenshot ability

Be able to discover ESPs through search

I adhered to the quadrant structure by incorporating the four pillars and positioning companies within the designated areas. Additionally, I integrated a popover feature that provides brief insights about a selected company, utilizing a visual language familiar to our users.

Similar quadrants

Given our interconnected system of related industries, why not showcase similar industry quadrants? This approach would enhance user discoverability of other quadrants, encouraging them to remain on our platform for an extended period.

ESP: 1st iteration

Is it possible to facilitate interactions within the quadrant to access information without relying on a popover? I experimented with the idea of selecting a company within the quadrant and displaying the information in an iframe adjacent to it.

I tested internally if it was intuitive that users would expect the iframe to interact with the quadrant itself. Is this easier than to just a click within the company name?

After considering resource constraints and user familiarity with quickly accessing company insights, we ultimately reverted to utilizing a popover.

Launch

For launch we chose to use company logos instead of text. However, a challenge emerged regarding company collision within the quadrant. When companies were closely positioned on the quadrant, collisions occurred, leading to confusion about their rankings. I presented several solutions to the engineering team:

Implement dynamic text placement adjustments upon collision, shifting the text to the left, right, or aligning it to avoid overlapping.

Eliminate text entirely and replace the text with company logos, accompanied by a "key" adjacent to the quadrant for reference.

Working enhancement for dec 2024

To improve the visuals of ESP, we aimed to upgrade our current 1x1 company logos by incorporating full logos within our key. Additionally, we are in the process of including company names. Despite encountering an issue with company collision, we are currently exploring a new solution, which involves adding a white stroke around the text or company logo.

Results

We have successfully scaled the production of ESP at an accelerated pace. We were able to produce over 150 ESPs for current industries we had on our platform at launch. The time required for our analysts to generate a spreadsheet for a new industry has significantly decreased from 20 hours to just 2-4 hours. This efficiency allows us to promptly present new industry ESPs to our clients, showcasing our ability to deliver timely and valuable insights.